Daily Chart

Daily Chart II

Half Hourly Chart

Nifty took support and closed above the rising

wedge resistance line shown on Daily Chart II.An Outside Day pattern was formed on daily charts which could be

signalling a reversal or deceleration of the current trend having

occured at the resistance of April 2011 top.

An outside day is when the day's candle completely encompasses the

previous day's candle. It must have a higher high

and a lower low than the previous day.The big range of the outside

day made today encompasses the range of the last two trading

sessions.Negative divergence on the Rsi14 & Macd and the stochastics

having given a sell and moved below the 80 levels supports this view.

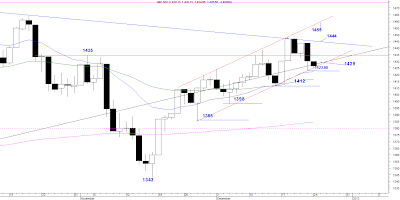

The half hourly chart shows the Nifty having broken down from a rising

wedge.However, a morning star pattern has been formed at today's lows

which is also the 23.6% fibo level, shown on the chart,

indicating the upmove from 5865 may continue.The pullback should find

resistance at 5913 to 5928

intraday at the support line of the rising wedge.With the daily charts

showing signs of early bearishness the

resistance may hold.If gives in 5965 could be tested. A cross above 5965

is necessary for further upsides.

A daily close below the Outside Day's low, which is 5865, will confirm

further bearishness to come.5839 is important support and a fall below

this will be an alert to the bulls.

Supports are marked on half hourly charts.

Write to vipreetsafetrading@gmail.com to subscribe to my Daily Newsletter

follow me on twitter http://twitter.com/#!/lucksr

Happy Trading !!

Lakshmi Ramachandran

www.vipreetsafetrading.com